State of the Global Polypropylene Resin Market

| General

Supplies of polypropylene resins started drying up last year, leading to a rise in price and buyers gobbling up any available stock. From Europe to the United States, processors are facing price increases that are setting new records for raw materials. Polypropylene resins support multiple manufacturing sectors, from automotive parts to smartphones.

The current shortage is causing costs to escalate while placing producers under pressure and fueling a rush to secure supplies around the globe. Unexpected winter weather in Texas created a further dilemma, as up to 85% of U.S. resin production stopped due to power blackouts in the state.

Rising Polypropylene Resin Prices Putting Manufacturers at Risk

At the start of 2020, most analysts predicted that the pandemic would lead to a 10% decline in global polypropylene resin production. The reality isn’t that simple. Although production slowed, the sudden price rise wasn’t part of the expert’s forecasts.

Although a 10% reduction in raw materials would influence global supplies, the current shortage points to a larger problem born from the pandemic. Producers are facing supply chain issues when sourcing raw materials while ongoing shortages and a failure to meet demand continue to drive up prices. Analysts expect a snapback from the market, although demand continues to increase around the world for products intended to support the COVID-19 pandemic.

Why is There a Supply Shortage of Polypropylene Resins?

Global constraints caused by the pandemic and strong demand for raw polypropylene resin materials put the market under pressure. Buyers have been purchasing any available stocks since the start of 2020, which put manufacturing capacity and distribution supply chains under pressure. Even with economies reopening, the demand is simply too great for suppliers to keep up.

Prices rose from $0.6c per pound in January and currently, the average cost exceeds $0.30c a pound compared to December 2019. With everyone scrambling to secure stock on the open market, traders and buyers are driving up the prices due to the limited supply. Depleted inventories, hurricane-related shipping delays, and disruptions to export operations were the main culprits causing this sudden rise in cost and the lack of available supplies.

How Will the Polypropylene Resin Market Recover?

Over the next five years, demand for polypropylene resins will continue to increase and help the market to grow at a roughly 6% compound annual growth rate (CAGR). Increased use of plastics in every industry, from automotive parts to convenient packaging, is driving the growth of the manufacturing sector.

The largest consuming markets, like the Asia-Pacific, and emerging demand for products like face-shields are putting additional pressure on the industry. Increasing production capacities to support a burgeoning polypropylene resin market is the only way the industry will recover to pre-pandemic levels and relative prices.

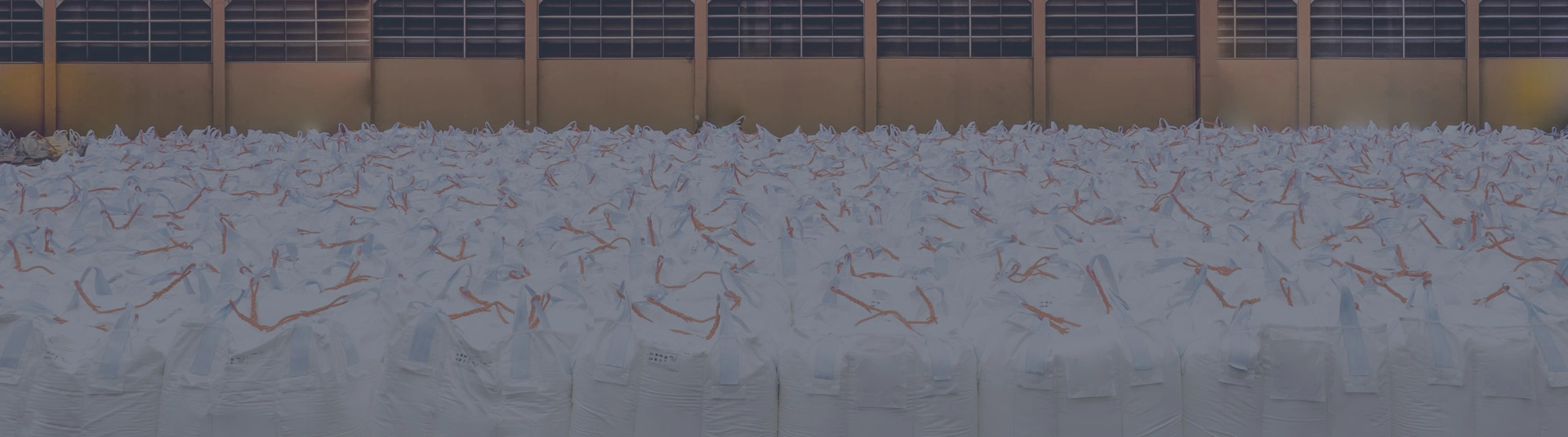

Manufacturing of FIBCs with Polypropylene Resins from Palmetto Industries

At Palmetto Industries, we are working with all of our suppliers to try and mitigate any rising costs as much as possible. While the global supply of polypropylene resins is putting some manufacturers at risk, we remain committed to helping you solve your flexible packaging needs.